18+ 20/4/10 rule calculator

Remember to make a 20 down payment. The 20410 rule uses straightforward math to help car shoppers figure out their budget.

How Much Car Can You Afford Why The 20 4 10 Rule Is Bad Advice Youtube

Descartes rule of signs calculator.

. Simpsons rule calculator. 20 4 10 rule calculator. Keep the total of your car payment and insurance premiums below 10 of your gross monthly paycheck.

With a 5000 down payment as suggested by 20410 a purchaser with financing at 6 percent interest can afford a vehicle costing 26290. The 20410 Rule says that you should. Here we take a 4 item subset r from the larger 18 item menu n.

4 The maximum term of your auto loan. The rule states that you should spend at least strong 20 of the price of the car on the down payment dont get a loan that last longer than strong 4 years and the total amount of money you spend per month on car related expenses should be no. Lets first breakdown what each number represents within the 20410 rule.

Using The 20410 Rule. Although these guidelines are based on salary credit and savings your personal. Put down at least 20 of the purchase price.

The rule of thumb is that car buyers will always deposit 20 reimburse the car in 4 years and never pay more than 10. The 20410 Rule helps simplify the budgeting process and takes some of the stress out of car shopping. At the same local car dealership that Kyle visited there was a Honda Accord 18 months old already depreciated by 25 percent from the new value and yet still quite close to.

Finance for 4 years or less. Thats about 11000 less than the average. Therefore your down payment should be 5000.

Choose 4 Menu Items from a Menu of 18 Items. If the menu has 18 items to choose from how many different answers could the customers give. Auto Financing Rule of Thumb.

The empirical rule calculator also a 68 95 99 rule calculator is a tool for finding the ranges that are 1 standard deviation 2 standard deviations and 3 standard deviations from. The 20410 rule of auto loans. If the value of the car is 50000.

Those three numbers cover every major car budget category. The 2010 rule says your consumer debt payments should take up at a maximum 20 of your annual take-home income and 10 of your monthly take-home income. Unfortunately its a longstanding rule that fails to consider the lack of significant.

4 years or 48 months. 20 down no longer than a four-year term. The closest thing to magic sauce is the 20410 formula endorsed by many advisers.

20 4 10 rule calculator. You can pay even more percentage depending upon your own budget or condition of that bank or dealer which you pay. According to the formula you should make a 20 down payment on a car with a four.

The 20 in 20410 rule is the 20 down payment of the car. Its important to note that this rule is far from perfect. Thats almost 500 more just in interest.

A restaurant asks some of its frequent customers to choose their favorite 4 items on the menu. 72 months X 17523 monthly payment 1261656. 20 The percentage you should put down on the purchase of your car.

You have to pay first while buying the car. The 20410 rule is a budgeting strategy for buying a car. 25000 020 5000.

And dont spend more than 10 of your income on monthly vehicle expenses. Using this rule to purchase a car is a wise financial decision because it helps you buy a car that you can afford to pay for and maintain. Descartes rule of signs calculator.

Potential Drawbacks to the 20410 Rule. The finance managers at Birchwood Credit. The 20410 rule is a useful formula to find whether your desired car will fit in your budget without causing you to end up in debt.

The minimum down payment you should make. Therefore we must simply find 18 choose 4. You would pay at least 10000 down payment.

For the median household income of around 60000 the 20410 rule would suggest spending no more than 6000 a year on a vehicle thats 500 per month. The 20410 rule is to be used when youre looking to finance a car. The Empirical Rule which is also known as the three-sigma rule or the 68-95-997 rule represents a high-level guide that can be used to estimate the proportion of a normal distribution that can be found within 1 2 or 3 standard deviations of the mean.

Plus thats two more. Take out a car loan for no more than four years. 48 months X 25289 monthly payment 1213872.

A car has a price tag of 25000.

How To Finance For A Car With The 20 4 10 Rule Skook Auto Sales

Matholicism The Rule Of 72 Is A Cool Trick In Financial Facebook

The 20 4 10 Rule How Much Car Can I Afford

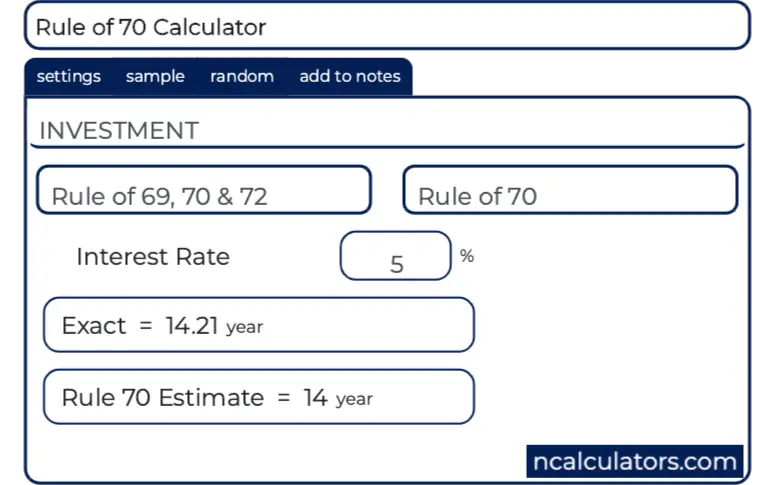

Rule Of 70 Calculator

How To Finance For A Car With The 20 4 10 Rule Skook Auto Sales

The 20 4 10 Rule How Much Car Can I Afford

Ejercicios De Order Of Operations Online O Para Imprimir

The 20 4 10 Rule How Much Car Can I Afford

:max_bytes(150000):strip_icc()/couple-in-car-7c7c152f08c9453da3b40cc2f81c5e15.jpg)

20 4 10 Rule Of Thumb For Car Buying

Ejercicios De Order Of Operations Online O Para Imprimir

Car Affordability Calculator How Much Car Can I Afford Moneyunder30

Should You Use The 20 4 10 Rule When Financing A Car Is There A Different Way You Can Calculate What You Can Afford To Spend On A Car Quora

The 20 4 10 Rule How Much Car Can I Afford

Fractional Calculator Measuring Tools Rowley

J2vsa Fitness Swimming Second Edition Pdf

The 20 4 10 Rule How Much Car Can I Afford

How Much Car Can You Afford Why The 20 4 10 Rule Is Bad Advice Youtube