No federal income tax withheld on paycheck 2020

In certain circumstances the IRS allows an employee to withhold zero federal taxes from every paycheck. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

When you file as exempt from withholding with your employer for federal tax.

. When you file as exempt from withholding with your employer for federal tax withholding you dont make any federal income tax payments during the year. The amount of income tax your employer withholds from your regular pay. The new form called Form W-4.

You didnt earn enough money for any tax to be withheld. If your employees feel they should be contributing more than what is auto calculated they can enter. Employees Withholding Certificate goes into.

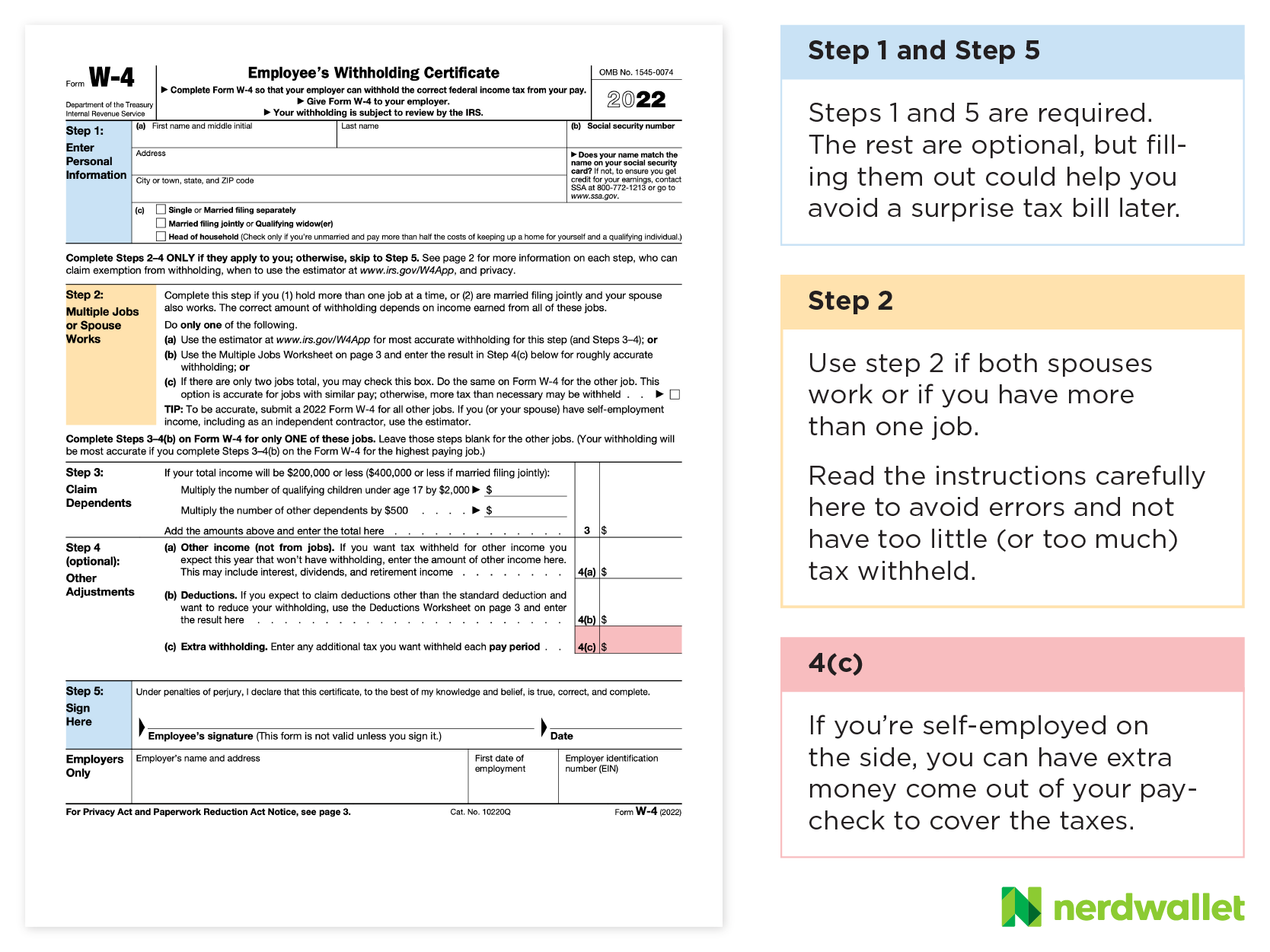

Use this tool to. The IRS and other states had made sweeping. Get W4 Form 2022 Every worker in the United States should file Form W4 accurately so that the taxes withheld from their income throughout the tax year is appropriate with their tax liability.

For employees withholding is the amount of federal income tax withheld from your paycheck. This is known as being tax exempt. Why is no federal tax withheld from 2020.

No withholding allowances on 2020 and later Forms W-4. Estimate your federal income tax withholding. The solution was to completely redesign how withholding tax is calculated resulting in an entirely new W-4 form.

A taxpayer is still subject to. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Reason 1 The employee didnt make enough money for income taxes to be withheld.

Intuit payroll services will then withhold taxes according to their tax setup. If no federal income tax was withheld from your paycheck the reason might be quite simple. Weve noticed that employees using the 2020 or later W-4 do not have federal taxes withheld until some threshhold is met.

The IRS has very specific rules. See how your refund take-home pay or tax due are affected by withholding amount. Up to 15 cash back The reason that you have an actual TAX LIABILITY has nothing to do with withholding but rather what your actual tax bill is of zero is that with an.

The following are aspects of federal income tax withholding that are unchanged in 2021. Weve had a few employees that have a couple. How It Works.

The percentage of tax withheld from your paycheck depends on what bracket your income falls in. For example for 2021 if youre single and making between 40126 and. If no federal income tax was withheld from your paycheck the reason might be quite simple.

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Paycheck Taxes Federal State Local Withholding H R Block

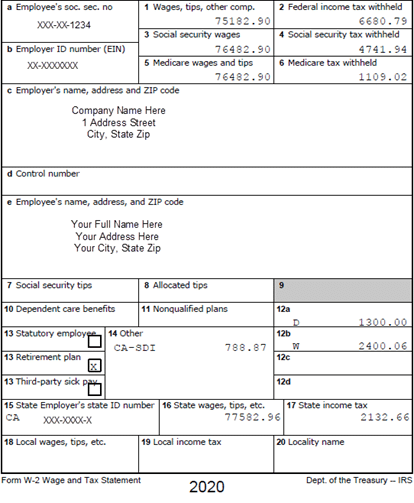

Understanding Your W 2 Controller S Office

What Happens If Federal Tax Is Not Deducted From My Paycheck Quora

How Do I Know If I Am Exempt From Federal Withholding

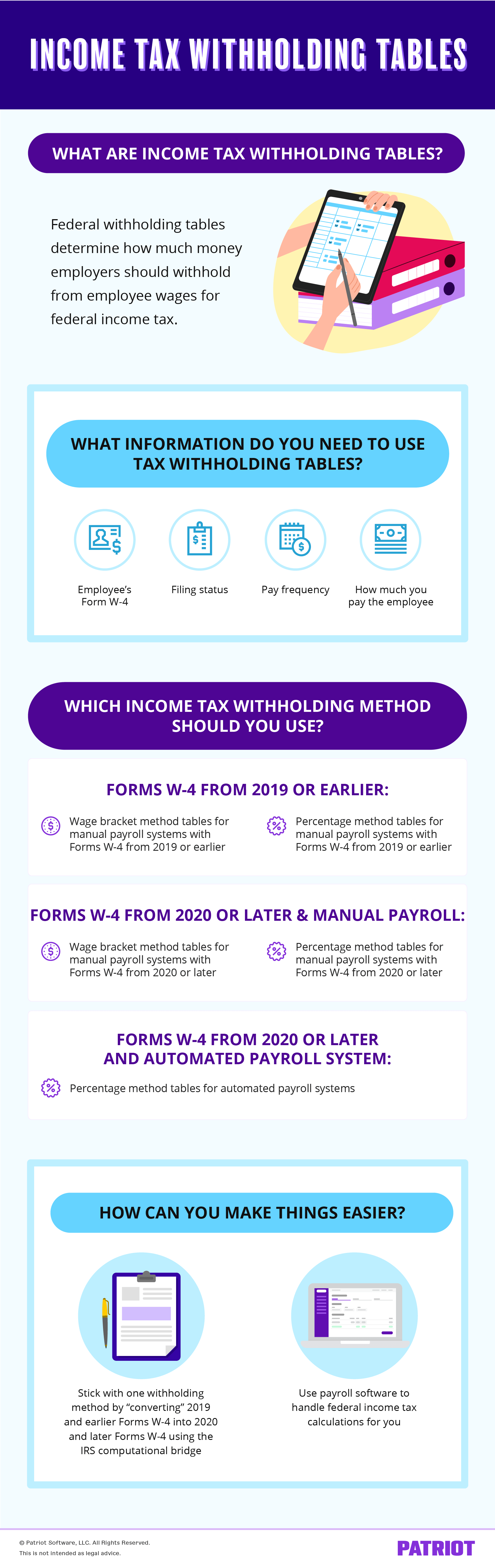

New In 2020 Changes To Federal Income Tax Withholding Tilson

Understanding Your W2 Innovative Business Solutions

2022 Income Tax Withholding Tables Changes Examples

W 4 Form What It Is How To Fill It Out Nerdwallet

Federal Tax Deduction Is Not Coming Out Of Check

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

State W 4 Form Detailed Withholding Forms By State Chart

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

Federal And State W 4 Rules

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Do I File A Tax Return If I Don T Earn An Income E File Com